Highlights from NSA Ventures' Annual Meeting

Today was the annual meeting of NSA Ventures, Iceland’s biggest (and oldest) venture fund. NSA Ventures is an evergreen fund, established by the government with a 3bn ISK initial endowment. The fund is not governmentally operated, but its board is nominated by the Minister for Industry and Innovation.

In yesterday’s Memo (sign up here) we put forth four predictions about the event. All predictions came partly or fully true. Below are highlights from the meeting.

- In 2015, the fund invested in one new company (Sólfar) and followed on in six comapnies.

- In 2015, the fund exited one company, Stjörnu Oddi, which had been in their portfolio since 1999.

- The fund hopes to exit four companies this year.

- The fund has little available cash to invest in new companies. They expect 1-2 deals this year. The number of deals depends on how the fund exits those companies.

- Silfra, an early stage fund NSA was preparing, is currently on hold. However, much prep-work has been done which will help start that project again later.

- There will be a full re-evaluation of the funds’ legal structure this year. This is not new, and is mentioned in the Ministry for Industry and Innovation’s plan for entrepreneurship. According to the plan, NSA will focus on investing in funds, rather than individual investments. Norðurskautið will discuss what this means in the coming weeks.

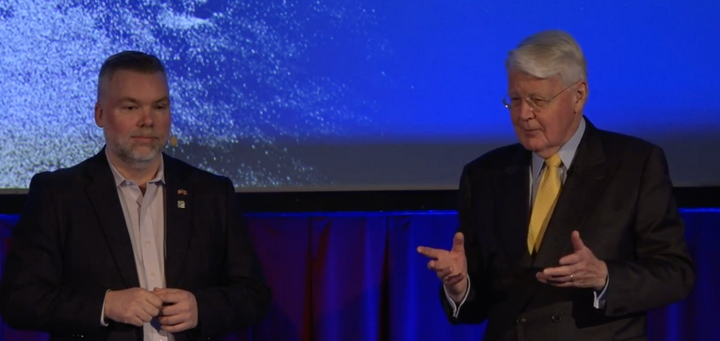

The picture is of Kjartan Pierre Emilsson, CEO and co-founder of Sólfar, who gave a talk on their VR project Everest at the annual meeting. Sólfar is a portfolio company of NSA. Image courtesy of Axel Ingi Jónsson.

Norðurskautið covers the Icelandic Startup and Tech scene. Follow us on Twitter or sign up for our mailing list to keep up to date. You can also join our Slack community – http://bit.ly/slack-is

[mc4wp_form]