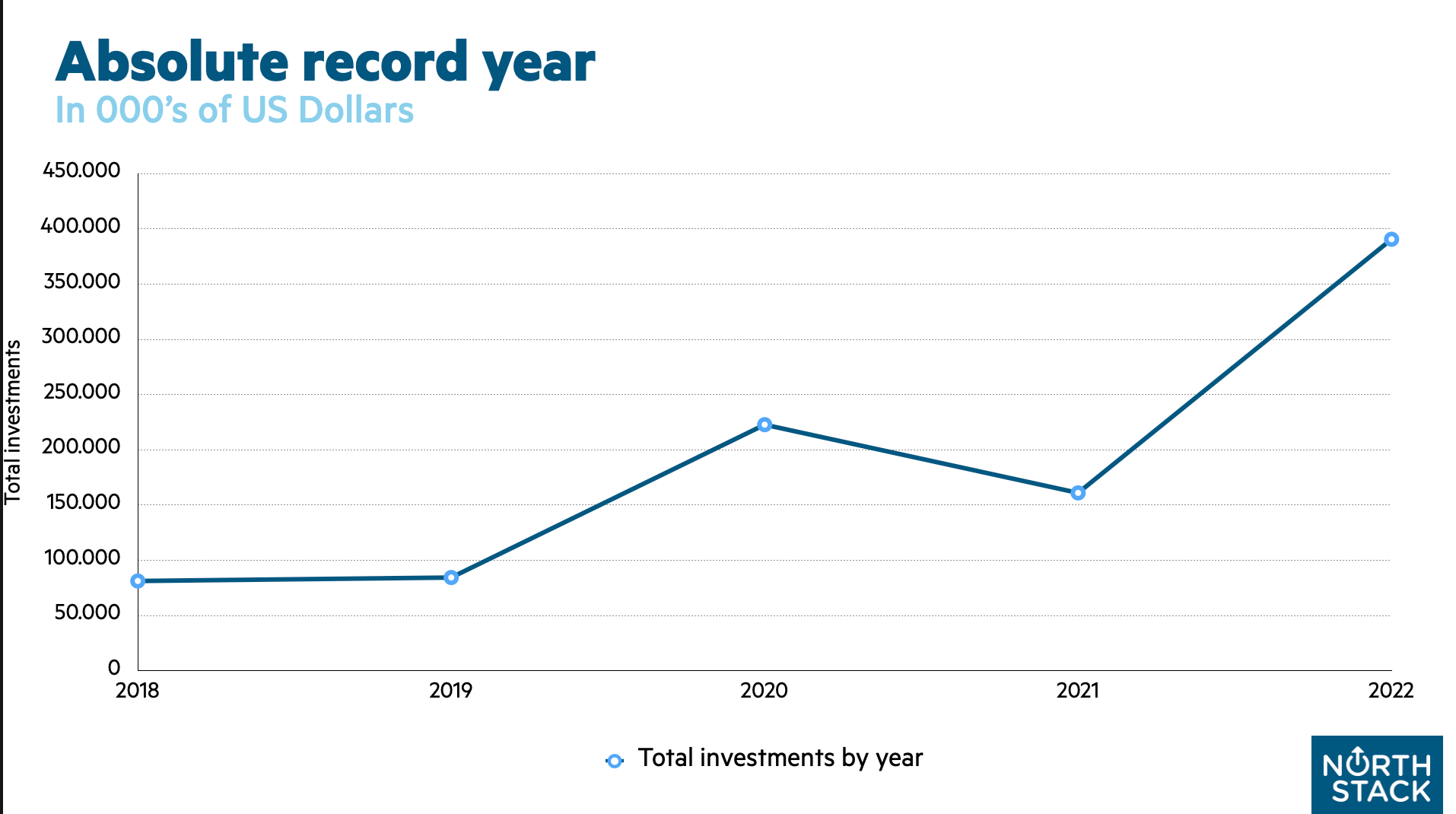

The Bestest Year Yet: Over $380 Million into Icelandic Startups

Looking back at 2022 we can surely say that the Icelandic Startup and VC ecosystem was lively.

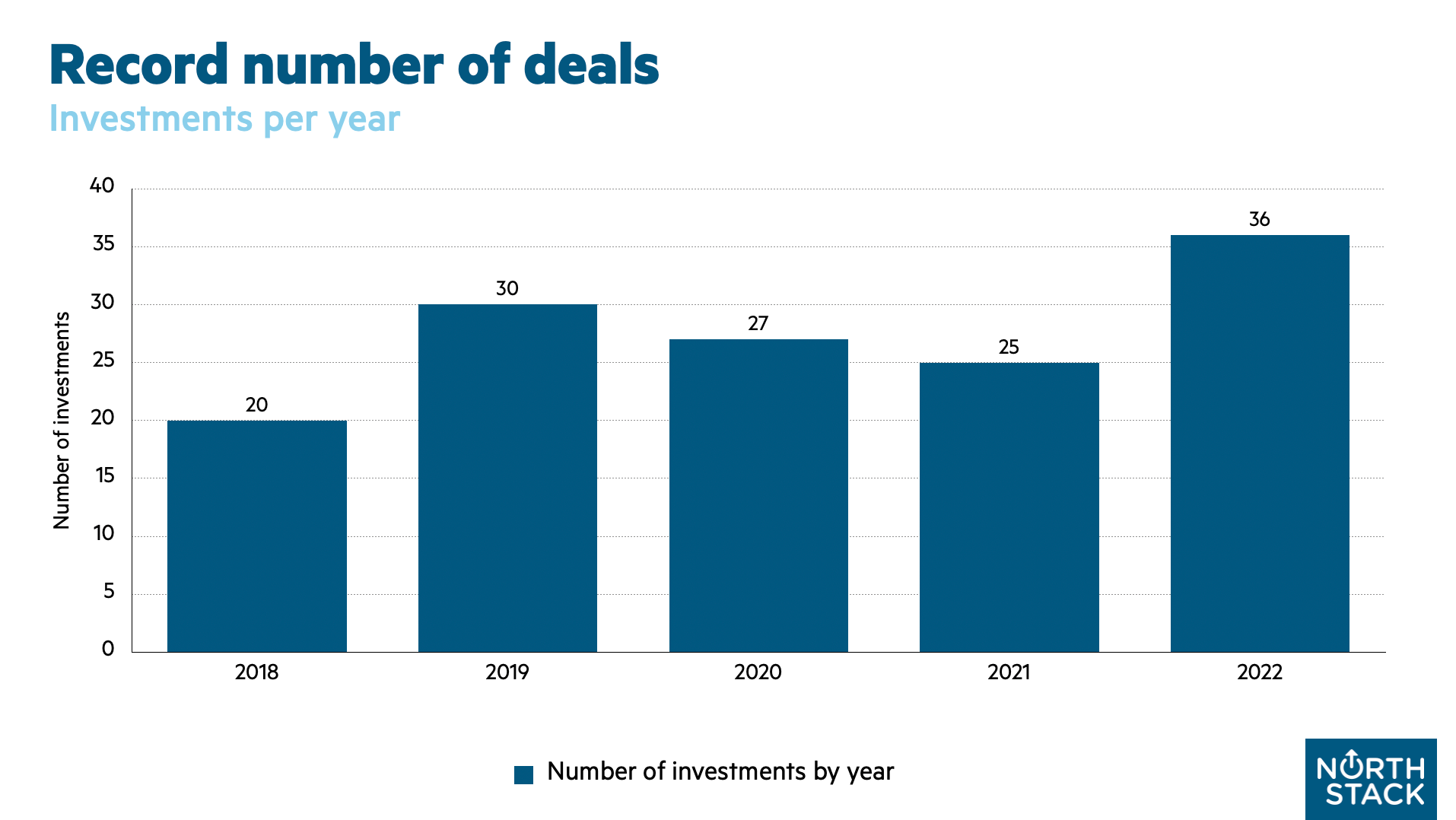

The year broke records for the most amount of deals in a single year recorded in Iceland and smashed the record for cumulative funding in a year.

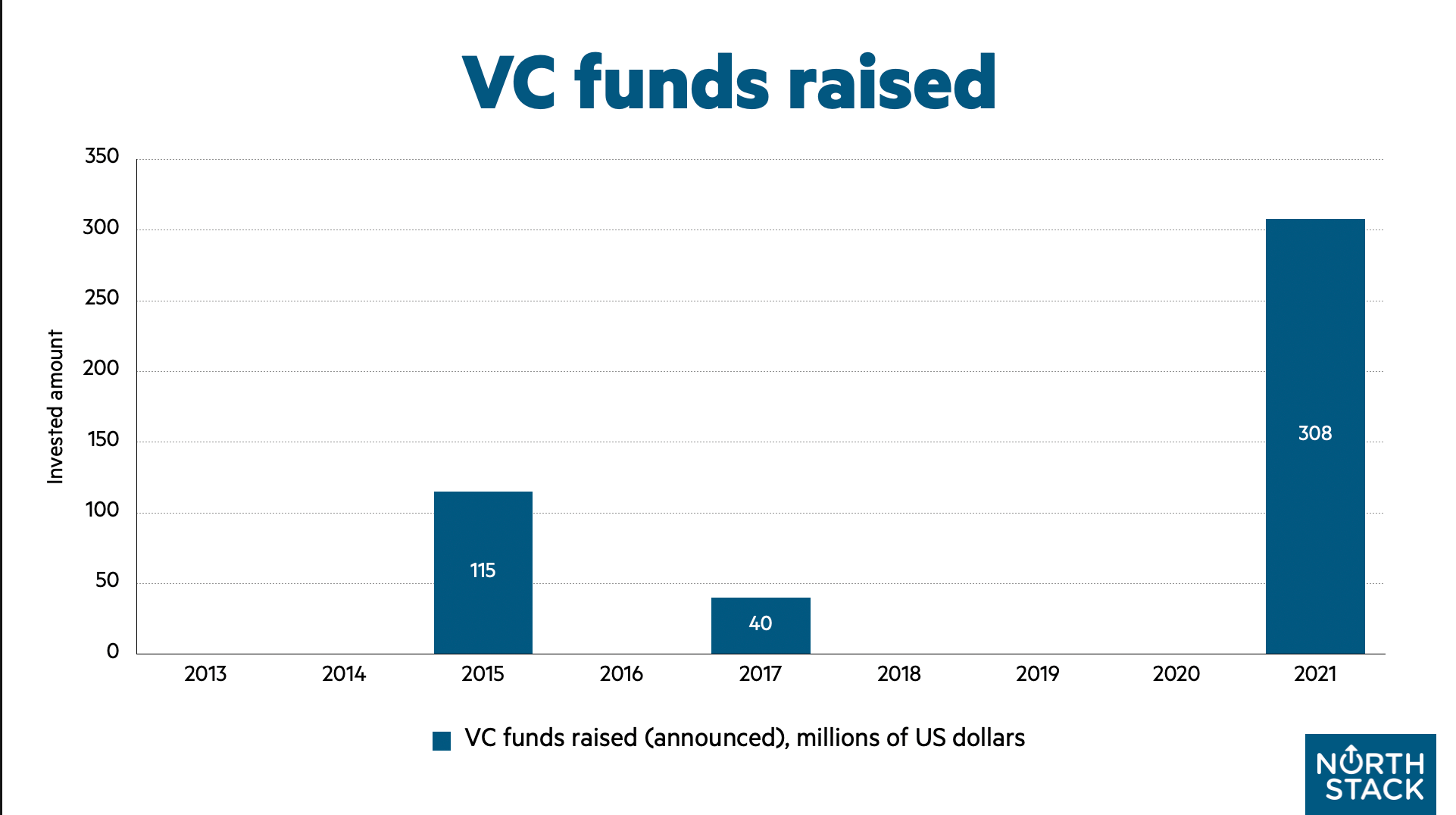

Maybe this should come as no surprise as Frumtak Ventures, Brunnur Ventures, Eyrir Vöxtur, Iðunn and Crowberry Capital closed fresh funds for a combined $308,000,000 in 2021.

To put that into context, look at the next graph.

So, as we predicted last year, with a lot of money flowing onto the scene this has been an active year.

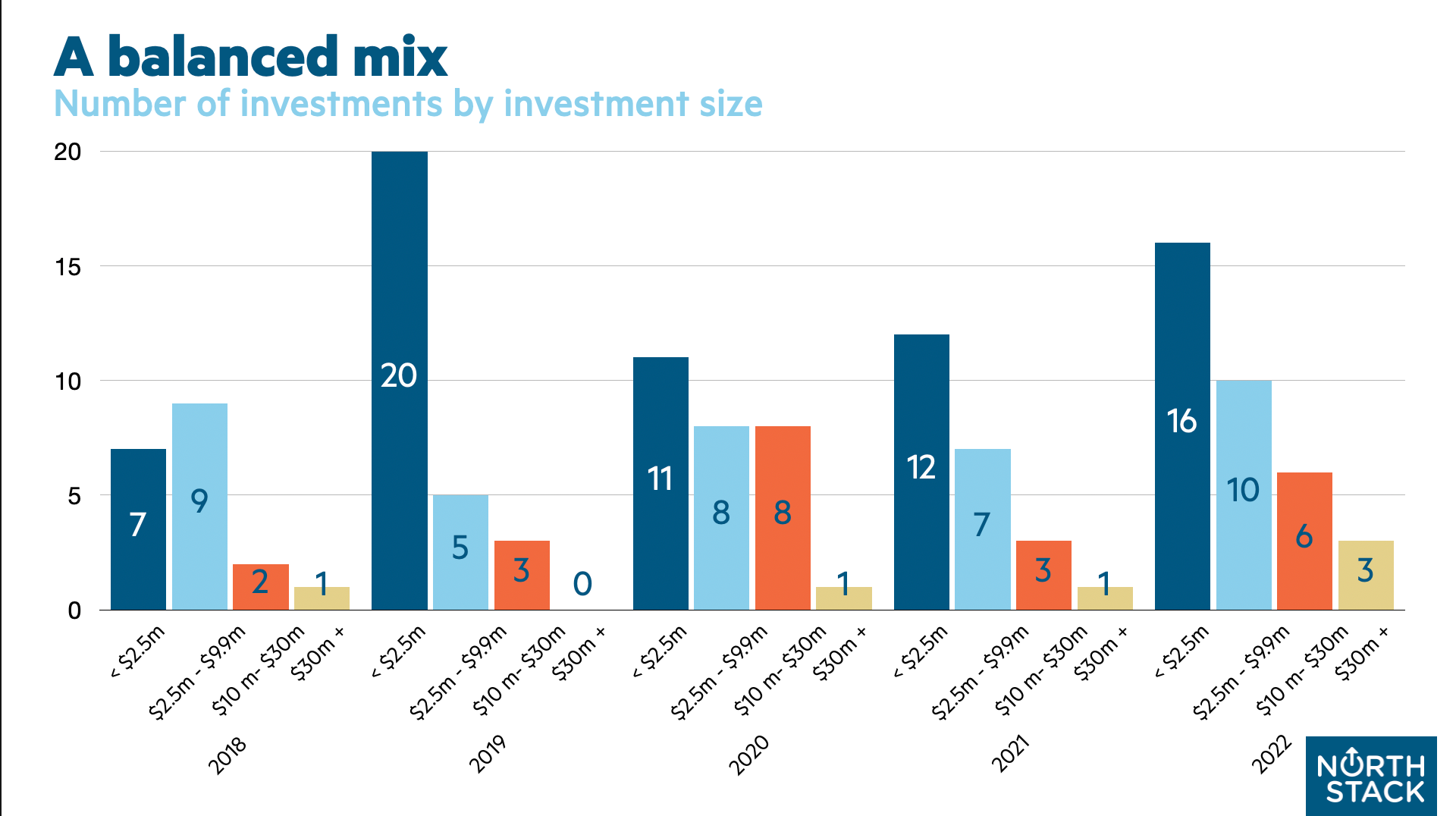

We've never seen more number of deals

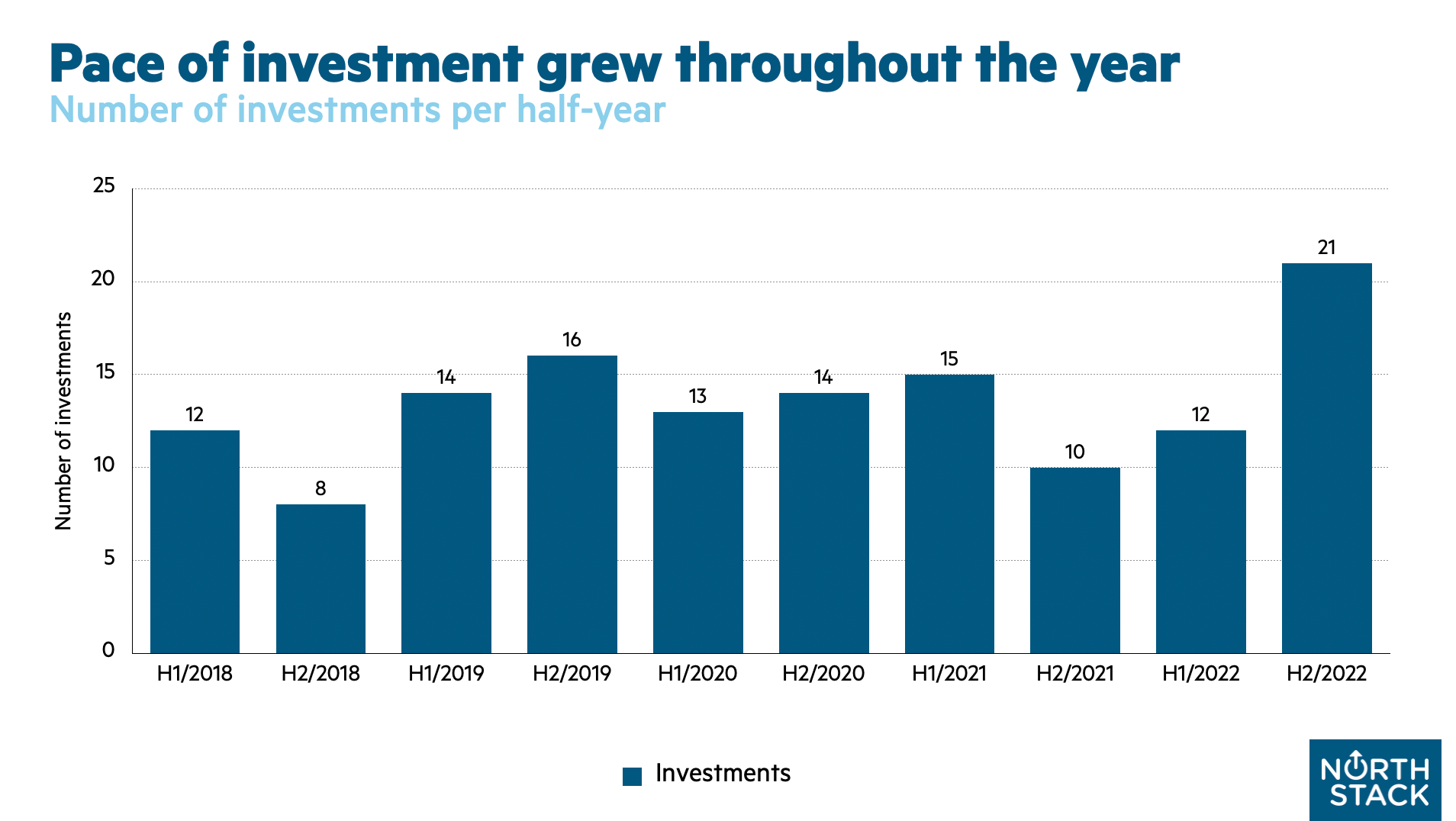

The pace of investment only grew throughout the year.

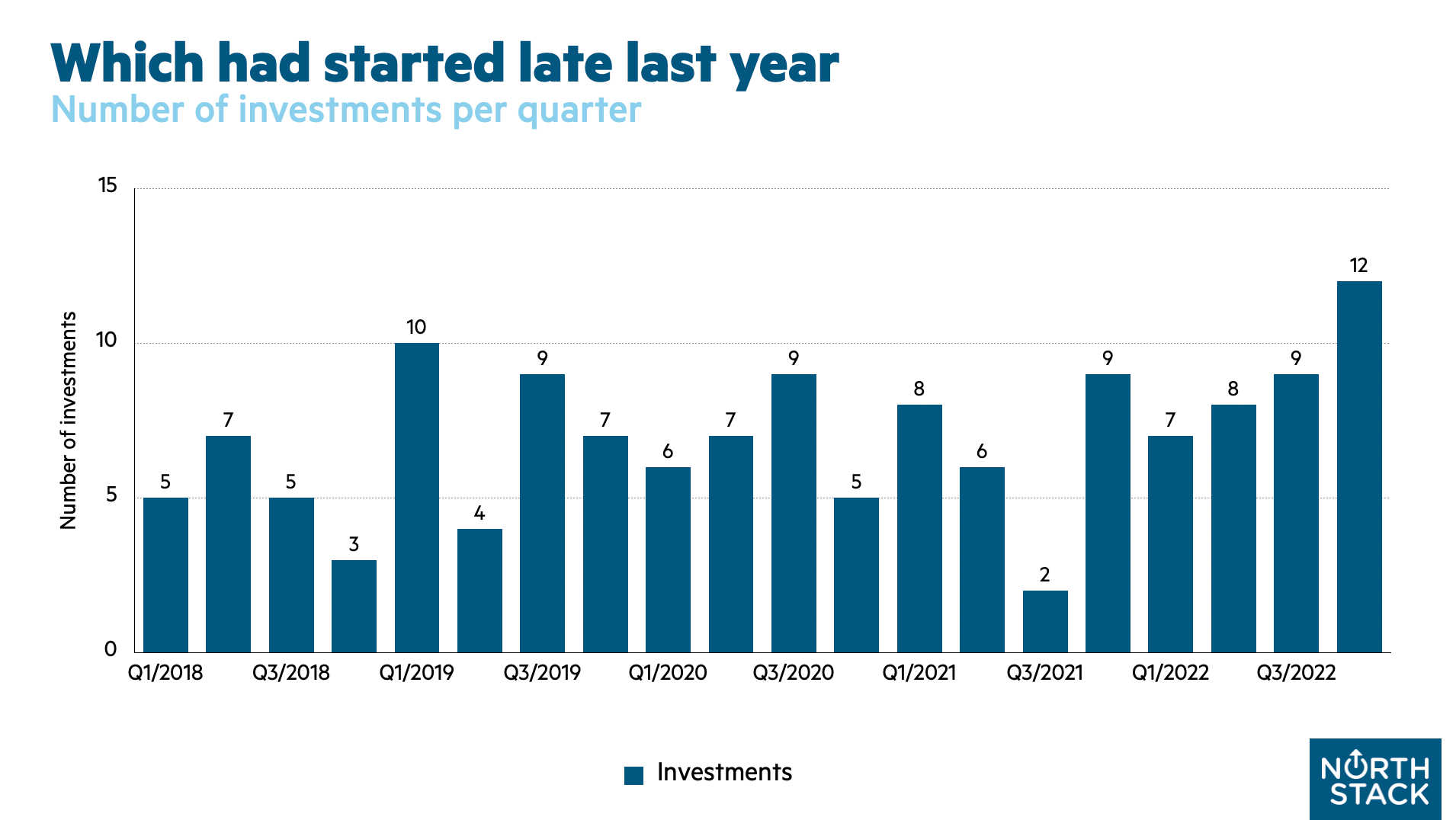

And if we look at quarters we can see that the pace had been picking up in the last part of 2021 after the funds closed their fresh capital raise.

Unsurprisingly, all these deals led to a record year in terms of total investment into Icelandic startups. However, that record was not just beaten but almost doubled.

Previously, the record year had been 2020, when $222,780,000 was invested into the ecosystem. Last year a grand total of $390,663,000 was invested into Icelandic startups.

There was a balanced mix between early to later stage investments.

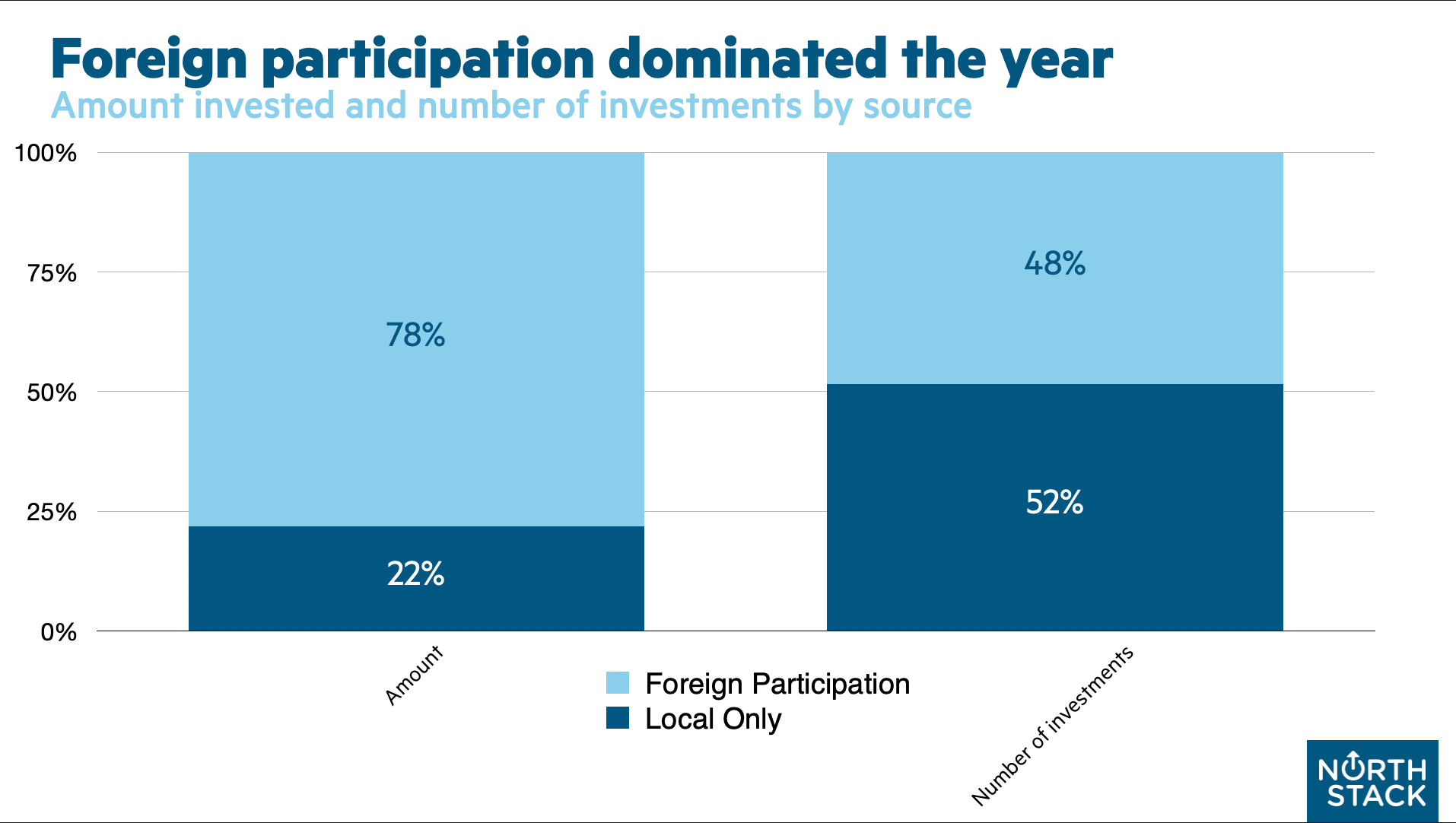

And as usual, the amount coming from foreign investors was a lot greater than the number of deals they participated in.

All in all, 78% of the total invested amount came from abroad while foreign investors only participated in 48% of the total number of deals.

This is unsurprising as growth funding continues to come from abroad rather than from domestic VCs.

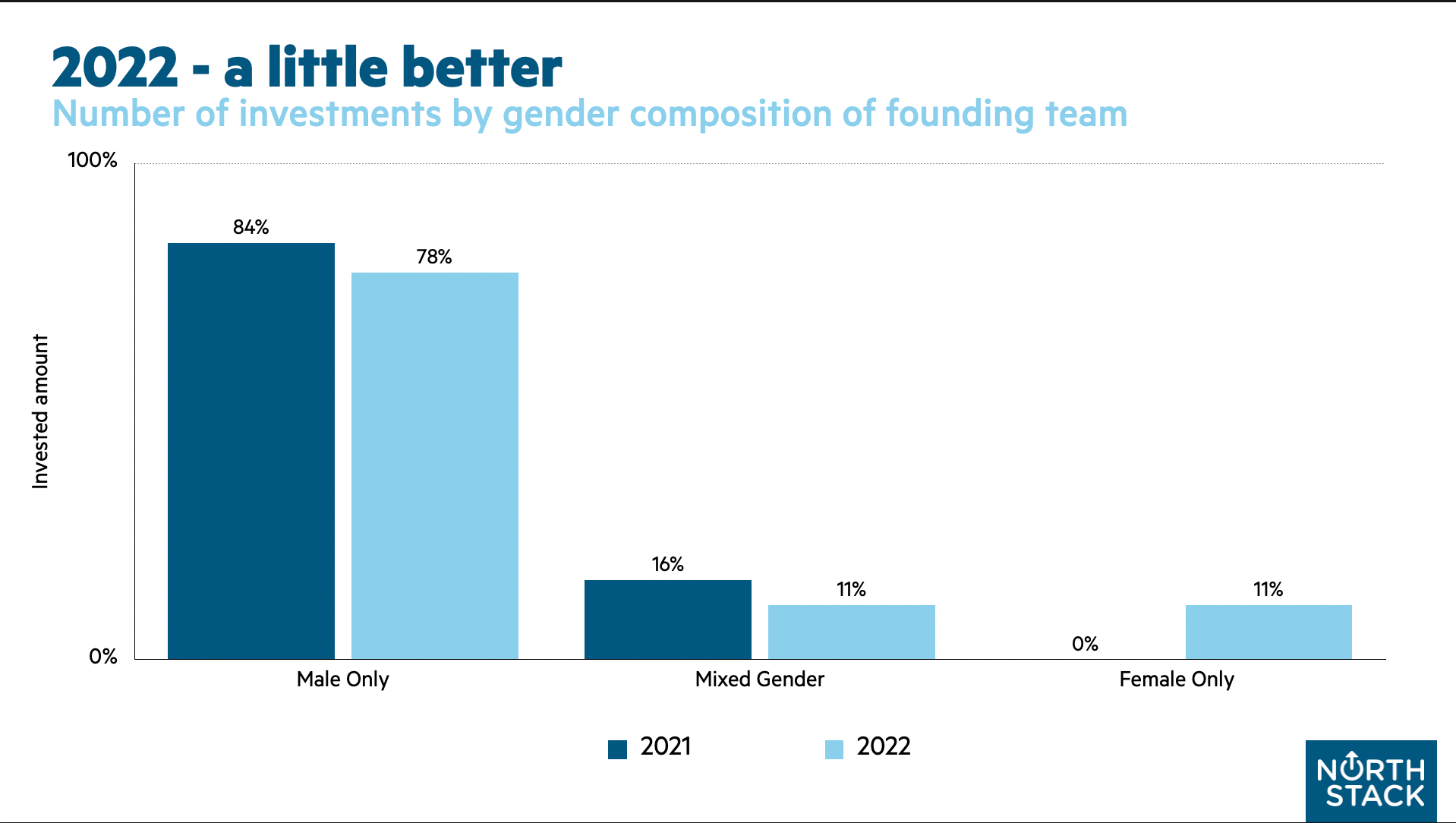

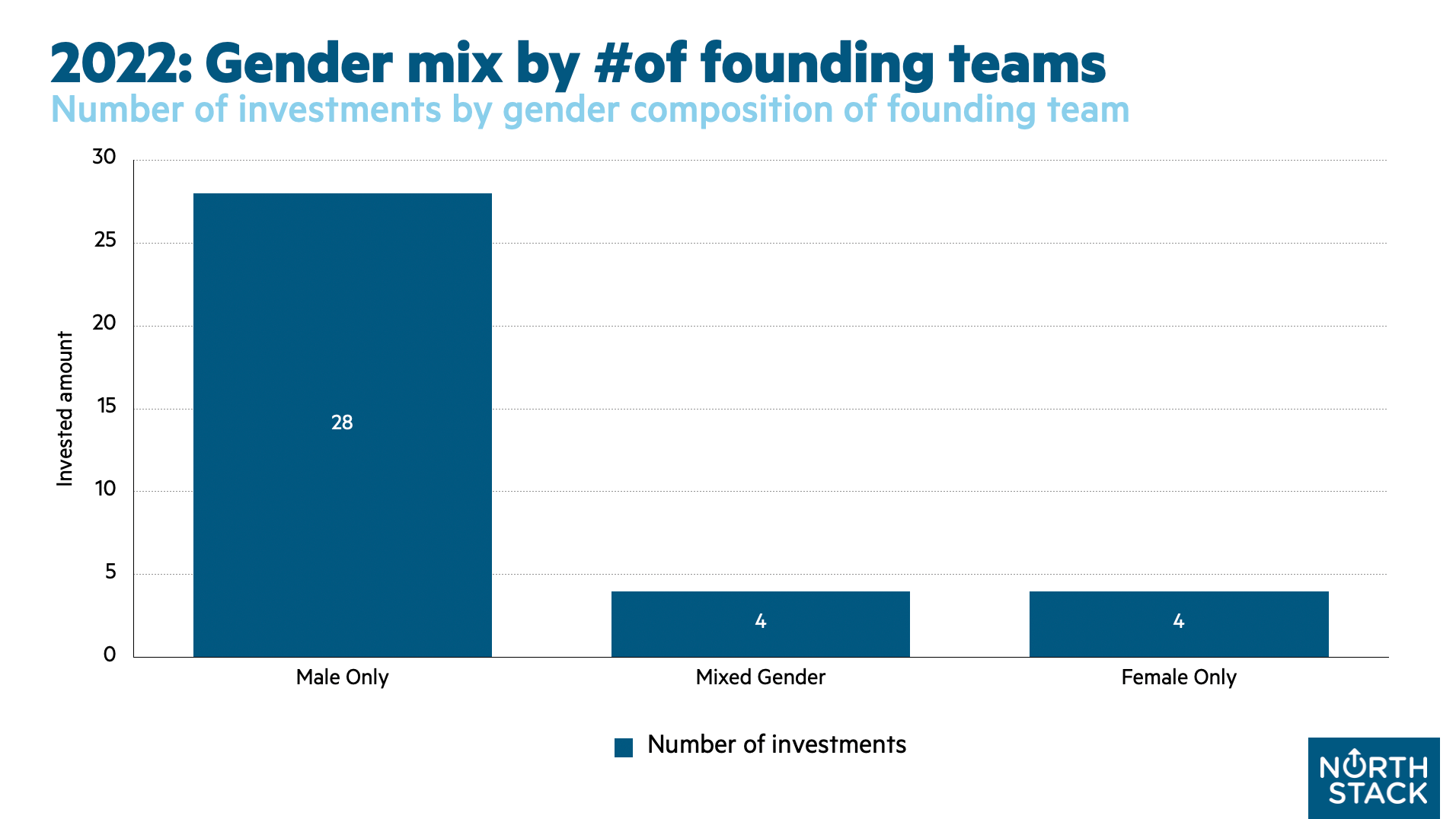

2021 was the first year we tracked the gender balance of the founding teams that received funding.

Although two years is not enough time to draw anything from, we see that the numbers look less grim than the year before.

And here are all the founding teams that received funding in 2022 by gender split.

Notes on method and data

- We report on investments that are reported or public knowledge, and time them based on the official announcement dates (i.e. press releases). This is to maintain integrity between different platforms and years.

- We only count investments into companies that have operations in Iceland (i.e. if Icelandic VC’s invest in companies that are fully abroad, we don’t count those in this report; nor do we track investments into Icelander founded companies that are located abroad).