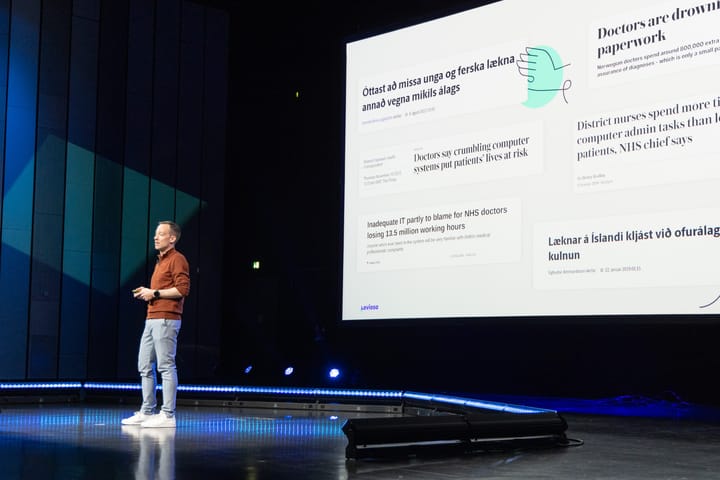

Prescriby raises a $2.1M round led by Crowberry Capital

Prescriby, the Canadian-Icelandic company of digital treatment plan software that prevents medication addiction, has secured $2.1 million in a funding round led by Crowberry Capital with participation from investors from Canada, Denmark, and Iceland.

“Prescriby is tackling a very serious problem that has big consequences for many. What got